Considering Selling Your Home?

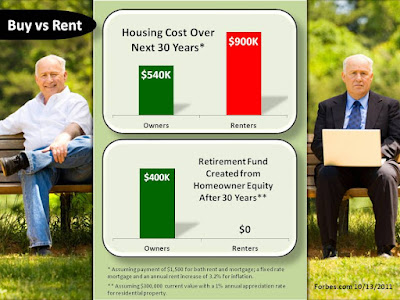

by The KCM Crew The First Question You Should Ask Your Listing Agent What is the most important thing a seller should look for when hiring a real estate agent to sell their house? We are often asked this question. Is it the size of the company they are licensed with? Is it their marketing program? Their years experience in the business? Should you choose the agent who suggests the highest listing price? There are many things that should be taken into consideration when hiring someone and giving them the responsibility for selling your home. In our opinion, the most important question you can ask a potential listing agent is a simple one: Do you truly believe that now is a good time to buy a home? Why should this matter when hiring someone to SELL your home? Buyers are nervous about purchasing right now. They want to know they are making an intelligent choice. We believe, especially in today’s market, you need to hire someone who realizes that this is one of the best times in American r...